How Pvm Accounting can Save You Time, Stress, and Money.

How Pvm Accounting can Save You Time, Stress, and Money.

Blog Article

A Biased View of Pvm Accounting

Table of ContentsAll about Pvm AccountingAll About Pvm AccountingSome Known Questions About Pvm Accounting.Pvm Accounting - QuestionsThe Definitive Guide for Pvm AccountingUnknown Facts About Pvm Accounting

Ensure that the bookkeeping procedure conforms with the regulation. Apply required building accountancy criteria and treatments to the recording and coverage of construction task.Connect with different funding agencies (i.e. Title Firm, Escrow Firm) relating to the pay application process and requirements required for settlement. Aid with executing and maintaining interior economic controls and treatments.

The above statements are meant to explain the basic nature and level of work being done by people assigned to this classification. They are not to be taken as an exhaustive list of obligations, obligations, and abilities needed. Personnel may be required to perform obligations beyond their regular obligations every now and then, as required.

Facts About Pvm Accounting Uncovered

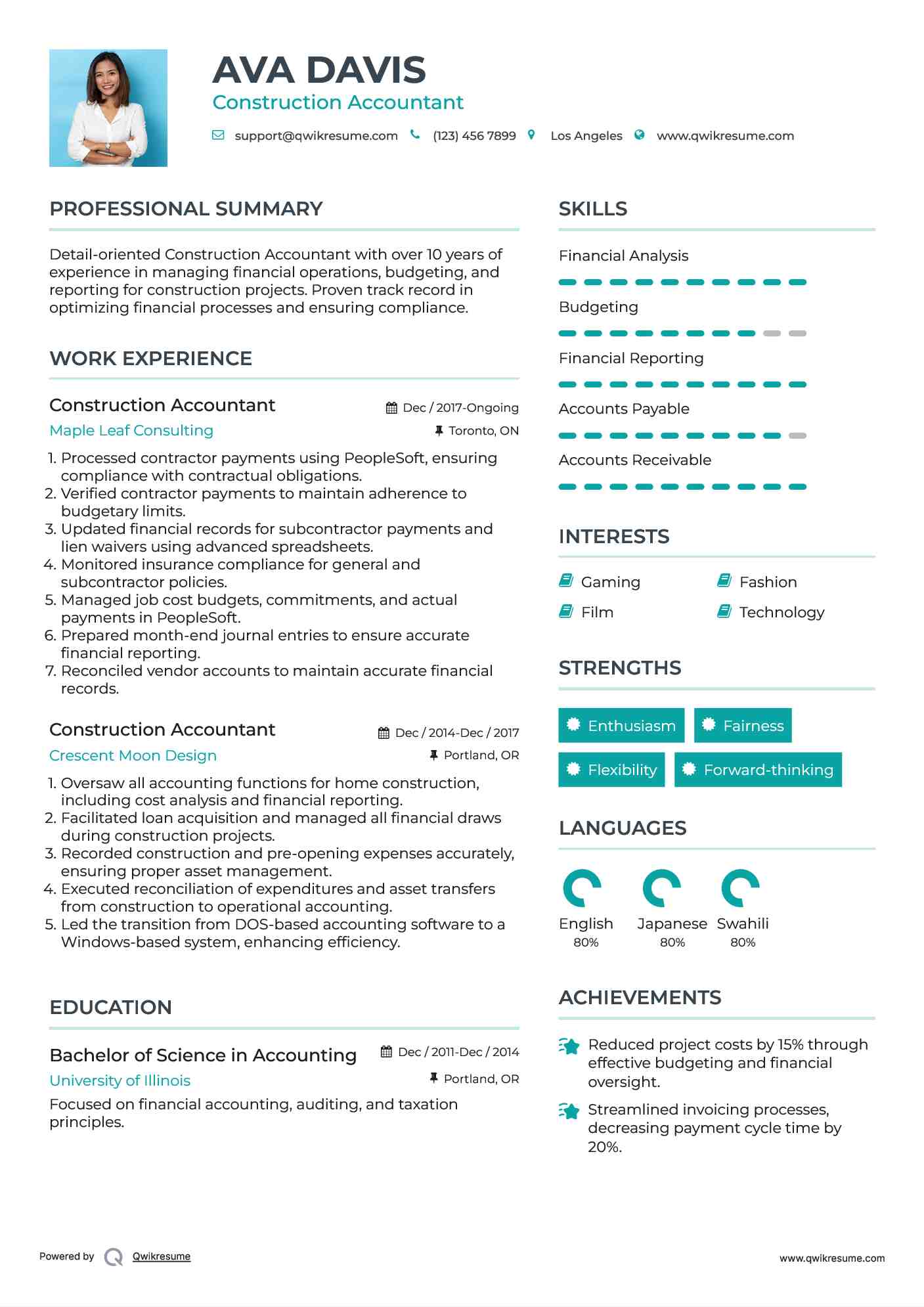

Accel is looking for a Building Accounting professional for the Chicago Office. The Building Accountant carries out a selection of accountancy, insurance coverage conformity, and task administration.

Principal duties consist of, yet are not limited to, managing all accounting functions of the business in a timely and precise fashion and supplying records and routines to the company's certified public accountant Company in the preparation of all economic declarations. Makes sure that all bookkeeping treatments and functions are handled precisely. Accountable for all economic documents, pay-roll, banking and everyday operation of the audit function.

Functions with Task Managers to prepare and upload all month-to-month invoices. Creates monthly Task Price to Date records and functioning with PMs to fix up with Job Supervisors' budget plans for each task.

The smart Trick of Pvm Accounting That Nobody is Discussing

Efficiency in Sage 300 Building and Realty (previously Sage Timberline Workplace) and Procore building and construction administration software program an and also. https://myanimelist.net/profile/pvmaccount1ng. Need to likewise excel in various other computer software program systems for the preparation of records, spread sheets and various other bookkeeping evaluation that might be called for by monitoring. Clean-up accounting. Need to possess solid organizational abilities and capability to prioritize

They are the economic custodians who ensure that construction projects remain on spending plan, abide by tax regulations, and maintain economic openness. Building accountants are not just number crunchers; they are tactical partners in the construction procedure. Their key role is to handle the economic elements of building and construction jobs, ensuring that sources are assigned effectively and economic dangers are decreased.

The Single Strategy To Use For Pvm Accounting

By maintaining a limited grip on project funds, accountants help stop overspending and economic obstacles. Budgeting is a foundation of effective building and construction jobs, and building and construction accounting professionals are crucial in this respect.

Browsing the facility internet of tax obligation regulations in the construction market can be challenging. Building accounting professionals are well-versed in these guidelines and guarantee that the job abides by all tax demands. This includes handling pay-roll taxes, sales taxes, and any various other tax obligation commitments certain to construction. To succeed in the duty of a construction accountant, people require a solid academic foundation in accountancy and finance.

Furthermore, accreditations such as Certified Public Accountant (CPA) or Certified Building Industry Financial Expert (CCIFP) are very pertained to in the market. Building and construction tasks usually include limited deadlines, transforming laws, and unanticipated expenses.

The Buzz on Pvm Accounting

Ans: Building and construction accountants develop and check budgets, recognizing cost-saving chances and guaranteeing that the job stays within budget. Ans: Yes, construction accountants take care of tax obligation compliance for building and construction jobs.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction firms have to make challenging options amongst numerous economic alternatives, like bidding process on one task over one more, selecting funding for materials or devices, or establishing a task's revenue margin. Building is an infamously volatile market with a high failure price, sluggish time to settlement, you can look here and inconsistent money circulation.

Regular manufacturerConstruction business Process-based. Production entails repeated procedures with conveniently identifiable expenses. Project-based. Production calls for various processes, products, and tools with varying prices. Taken care of area. Production or manufacturing takes place in a single (or numerous) controlled locations. Decentralized. Each job takes location in a brand-new area with differing site conditions and one-of-a-kind challenges.

About Pvm Accounting

Frequent usage of various specialty professionals and providers impacts efficiency and cash money circulation. Settlement shows up in complete or with routine settlements for the complete contract amount. Some section of settlement might be kept till project conclusion even when the service provider's job is finished.

While conventional producers have the advantage of controlled settings and enhanced production procedures, building firms have to regularly adapt to each brand-new task. Also rather repeatable projects need adjustments due to site problems and various other elements.

Report this page